7 Secrets From Two 401(k) Millionaires To Turbocharge Your 401(k)

Jul 16, 2021

I grew up in a family with very little money. That is one of the reasons why I am mindful of my money and careful with how I spend it because I know how tough it is to live with limited funds.

About two decades ago, when I just started my professional career, I would constantly worry about retirement. I wanted to make sure I will have enough money to spend when the time comes to give up my job with a steady paycheck.

Fast forward to present day and I don’t have the same concern now that I once had about retirement. I have over $1,000,000 in my retirement account and I crossed into the 7 figure territory before the age of 40. Now, I feel comfortable that I should do just fine when it comes time to hang up my working boots.

I felt pretty good about myself when my 401(k) account balance crossed the $1,000,000 mark. But I would have felt even better about myself if my wife didn’t already beat me to that level a few months earlier. She, too, achieved millionaire status in her 401(k) prior to the age of 40. There is no denying she is my better half for sure.

Open Up A 401(k) Account

401(k) plans are becoming more and more integral for Americans to save for retirement. According to the Bureau of Labor Statistics, only 23% of all workers participate in a pension plan with only a 15% participation rate for private sector workers (74% of state and government workers participate in a pension plan).

Pension plans are going the way of the dinosaurs. As a private sector employee, don’t rely solely on social security to get you through retirement or plan on your kids taking care of you. It is important to start saving for your own retirement and a 401(k) plan is a great vehicle to use.

Key Benefits Of A 401(k) Plan

I believe the tax benefits to a 401(k) make it a no brainer for you to contribute money into a 401(k) account.

Tax Deduction On Contributions

First and foremost, the tax deduction benefit is a key incentive for you to put money into a 401(k) account.

Pre-tax money is contributed into your 401(k) account. That means there are no income taxes charged on your contributions. Every dollar of contribution reduces your taxable income by a dollar. This is great motivation to put as much money into your 401(k) account as permissible.

If you are in the 24% federal income tax bracket, when you put a $1 into your 401(k), you can view it as 76 cents coming from you, and 24 cents coming from the federal government. Isn’t it great to get something from the government for once?

Tax Deferral On Income

Another tax benefit is that income generated from your investments in a 401(k) account is tax deferred. That means any income generated, be it interest income, realized capital gains or short term trading gains, is exempted from taxes until you start to withdraw from the account.

Deferring tax payments provides you with a greater amount to invest each year.

How My Wife and I Both Got To $1,000,000+ In Our 401(k) Before The Age Of 40

Now that I got the tax benefits out of the way, let me share with you the 7 secrets for turbocharging your 401(k) account. Hopefully, with these secrets, you too can reach millionaire status in your 401(k) account. Keep in mind my wife and I started with a balance of zero right out of college at the age of 22.

I followed the 7 secrets below to reach millionaire status just on my 401(k) balance alone before the age of 40. My wife also followed the 7 secrets below and reached her millionaire status in her 401(k) account before the age of 40 as well.

The secrets I am about to share with you worked wonders for my wife and me. Now, this might just be a giant coincidence. Or, more likely, these secrets actually work to help turbocharge our 401(k) balances and should help you as well.

Secret #1: Contribute The Maximum Amount

I opened up my first 401(k) account when I began my first full time corporate job at the age of 22 after graduating from college. I contributed the maximum amount permissible as an employee into my 401(k) during my first full year of work. Since that time, I have contributed the maximum allowable amount into my 401(k) year after year.

It is a similar story with my wife. She opened up her first 401(k) account at the age of 22 right after starting her first full time job. She has contributed the maximum amount to her 401(k) account since the beginning.

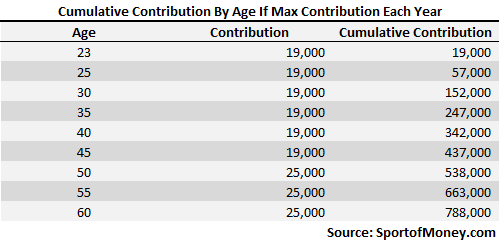

The current maximum contribution is $19,000 a year. If you are age 50 or older, you are allowed to contribute an additional $6,000 a year for a total contribution amount of $25,000 a year.

Let’s see where you end up just by contributing the maximum from age 23 (right after undergraduate school) to age 60 (right before the age for withdrawal):

If you just contributed the maximum amount each year starting from age 23 and just held it in cash, by the time you reach 60 years of age you will have $788,000 in your 401(k). You will not quite be a 401(k) millionaire yet but you will be over 3 quarters of the way there.

This is solely from contributing the maximum allowable employee contribution amounts as they stand now. This does not include any potential employer match or any return on your contributions.

Secret #2: Start As Early As Possible

As previously mentioned, my wife and I started contributing to our 401(k) right after we started our full time work at the age of 22. This brings us to secret #2, start as early as possible in contributing to your 401(k).

Time can be your best friend or your worst enemy. Turn time into your best friend by contributing early.

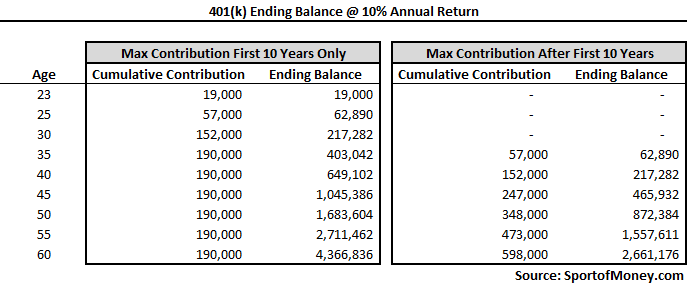

The below chart shows the power of early contribution compared to waiting even 10 years later to start your contribution.

The left side of the chart shows the ending balance at age 60 for someone who contributed the maximum amount into the 401(k) the first 10 years from age 23 to age 33. The total contribution made by the person amounts to $190,000. At a 10% annual return, the person will have approximately $4.37 million in the account by age 60.

The right side of the chart shows the ending balance for someone who didn’t contribute into the 401(k) until age 33, a whole decade later than the person on the left. The person on the right contributes the maximum amount from age 33 to age 60, a total of 28 years. The cumulative amount contributed into the 401(k) is close to $600,000.

Even with over 3 times the contributed amount, the person on the right still ends up with less than $2.7 million by the time the person reaches 60. The person on the right put in over 3 times the contribution but only ended up with 60% of the result.

This table shows you the power of starting early really pays off huge.

Secret #3: Put Your Money To Work

After you’ve opened up and contributed money into your 401(k) account, don’t let your contribution sit idly in your account in cash. My wife and I never did. We’ve always put our money to work.

In fact, we set up our contributions to go directly into an S&P 500 mutual fund. It didn’t matter to us if the S&P 500 was hitting an all-time high or took a dive and lost 20%, we continued to buy into the mutual fund once the contribution hits the 401(k) account.

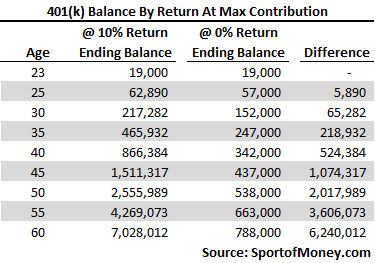

It is important to put your money to work. Money earning a 10% return (approximately the average annualized total return on the S&P 500 over the past 90 years) versus sitting in cash, over an extended period of time, can produce a sizable difference.

The above table shows someone contributing the maximum amount into the 401(k) account since the age of 23 and continued all the way to age 60. The first column shows what the balances will be at different ages given a 10% annual return. The second column shows what the balances will be at different ages given a zero percent annual return.

As you can tell by the difference column, the differences can be staggering if you are able to obtain a 10% annual return versus not putting the money to work and holding it in cash. By the age of 60, investing in the S&P 500 can produce over $6,000,000 of total value.

Definitely invest your money and put it to work. It is imprudent and unwise to just leave your contribution sitting in cash or a money market account.

Secret #4: Automate Contributions

Since the beginning, I’ve set up an amount to go into my 401(k) account automatically from each paycheck. Without fail, I’ve continued this practice to this day. My wife has done the same since the beginning.

It is simple to do with most 401(k) plan. Set it up so that an amount automatically gets contributed into your 401(k) account. This way, you pay yourself first and, best of all, since it never hit your bank account, you won’t even miss it.

You will be surprised how easy it is to budget around only the actual cash received and you won’t miss the amount put into your 401(k). My wife and I certainly didn’t miss the contributed amounts since they were never in our bank accounts to begin.

Secret #5: Take Full Advantage Of Employer Match

There is nothing better for me than maximizing my benefits in a given situation. If your company offers a 401(k) match, you need to take full advantage of it.

All my employers through my approximately 20 years of work have offered a 401(k) match. I view the match as free money. Who can pass up getting free money? I have taken full advantage of my employer’s kindness. My wife has done the same as well.

Your employer might offer to match a percentage of your contribution up to a percentage of your salary. A common one is a 50% match on up to 6% of your salary. That means, for example, if you make $100,000 a year, your company will put in $3,000 (50% match of your contribution) into your 401(k) account if you put in $6,000 (6% of your salary) of your own money for a total contribution of $9,000.

Secret #6: Utilize Employer Contribution

The maximum annual amount for total employee and employer contributions is the lesser of (a) 100% of the employee’s compensation or (b) $56,000 (or $62,000 over the age of 50). That means the employer can put additional contributions into your 401(k) account over and above the typical employer match.

Not all employers offer the ability to contribute above and beyond the individual employee limit and the match. But one of my employers provided an option for me to reduce my pay; and my employer took that reduction amount and contributed it into my 401(k) plan as part of the employer’s contribution.

I took full advantage of this and opted for my employer to contribute as much as possible into my 401(k) account. There were years when I put in $50,000 (my employer used a formula that didn’t quite get to the maximum contribution limit) into my 401(k) through a combination of employee contribution, employer contribution (economically came from me as this resulted in a dollar for dollar reduction in pay for me), and an employer match.

This most certainly helped contributed to me reaching 7 figures in my 401(k) account before the age of 40. If your employer provides that option for you, take full advantage of it if you want to turbo charge your retirement balance.

Secret #7: Don’t Raid The Plan Before Retirement

My wife and I have taken full advantage of the 6 secrets listed above. The last remaining secret is the most important of all.

Once you have built up a 401(k) balance, be it thousands, tens of thousands or even millions of dollars, keep this last secret to heart. Do not raid your 401(k) account. There is a 10% penalty for early withdrawal which, hopefully, serves as a major deterrent.

The whole purpose of having a 401(k) to begin with is for retirement. If you are not retired yet, don’t touch the money. Continue to save, contribute and invest in your 401(k). Your future self will thank you later.

Wait, Are The 7 Secrets You Listed Really Secrets!?!

Now you might be thinking “wait a minute, they don’t feel like secrets to me. The so called “secrets” you have listed above are very obvious and are no-brainers. I want my time back.”

Well, to that, I ask you if they are not secrets, then why are you not a 401(k) millionaire? If they are so obvious, then how come the average 401(k) balance is only $95,600 according to Fidelity Investments’s Q4 2018 Retirement Analysis?

The Fidelity Retirement Analysis also reveals the breakdown of average 401(k) balances by age:

- Ages 20-29: $10,500

- Ages 30-39: $38,400

- Ages 40-49: $93,400

- Ages 50-59: $160,000

- Ages 60-69: $182,100

- Ages 70+: $171,400

Now based on the account balances above, I do not believe most Americans know the way to build a big 401(k) nest egg. My wife and I do and have. You, too, can build a substantial 401(k) balance and be a 401(k) millionaire one day. I do believe my 7 secrets to turbocharge your 401(k) will work for you if you apply them early, consistently, and stay the course.

To the audience: Are there any other secrets I am missing? How is your 401(k) account doing? Are there reasons why you might still have a tough time becoming a 401(k) millionaire even after now knowing the 7 secrets to turbocharge your 401(k) balance?

Source: https://www.sportofmoney.com/7-secrets-from-two-401k-millionaires-to-turbocharge-your-401k/

Photo by Tima Miroshnichenko from Pexels

Are you ready to elevate your employee retention stats with The NetWellth Strategy? Let's connect and explore how our transformative approach can help you keep your top talent.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.